Fomc September 2021 Live

FOMC releases its. We describe the meeting as highly anticipated because the issue of the Fed tapering its asset purchases is very much on the minds of most market participants.

Live Data Coverage September Federal Reserve Meeting Rate Decision

November and December FOMC Meetings Likely To Be Live The Federal Open Market Committee FOMC will hold a highly anticipated meeting on September 21-22.

Fomc september 2021 live. FOMC Meeting Schedule 2021 FOMC Federal Open Market Committee is the branch of the US Federal Reserve that determines the course of monetary policy. Neuberger Berman Managing Director Dan Flax joins the Yahoo Finance Live panel to discuss Apples earnings results. Like and Subscribe for more daily market analysis and reactionGet connected with AmplifyLIVE.

Fomc meeting today live time. GBPUSD News Gold dives to over one-week lows below 1780 level. Live Trading Session FOMC Week Bitcoin Forex Webinar September 20 2021 - YouTube.

After a softer August jobs report the Fed revised its expectation on the unemployment rate by the end of 2021 to 48 compared to 45 in June. Forex Live Premium. Fomc meeting Jerome Powell says taper could start in 2021 but no rush on rate hike At the Feds most recent policy meeting in late July I was of the view as were most participants that if the economy evolved broadly as anticipated it could be appropriate to start reducing the pace of.

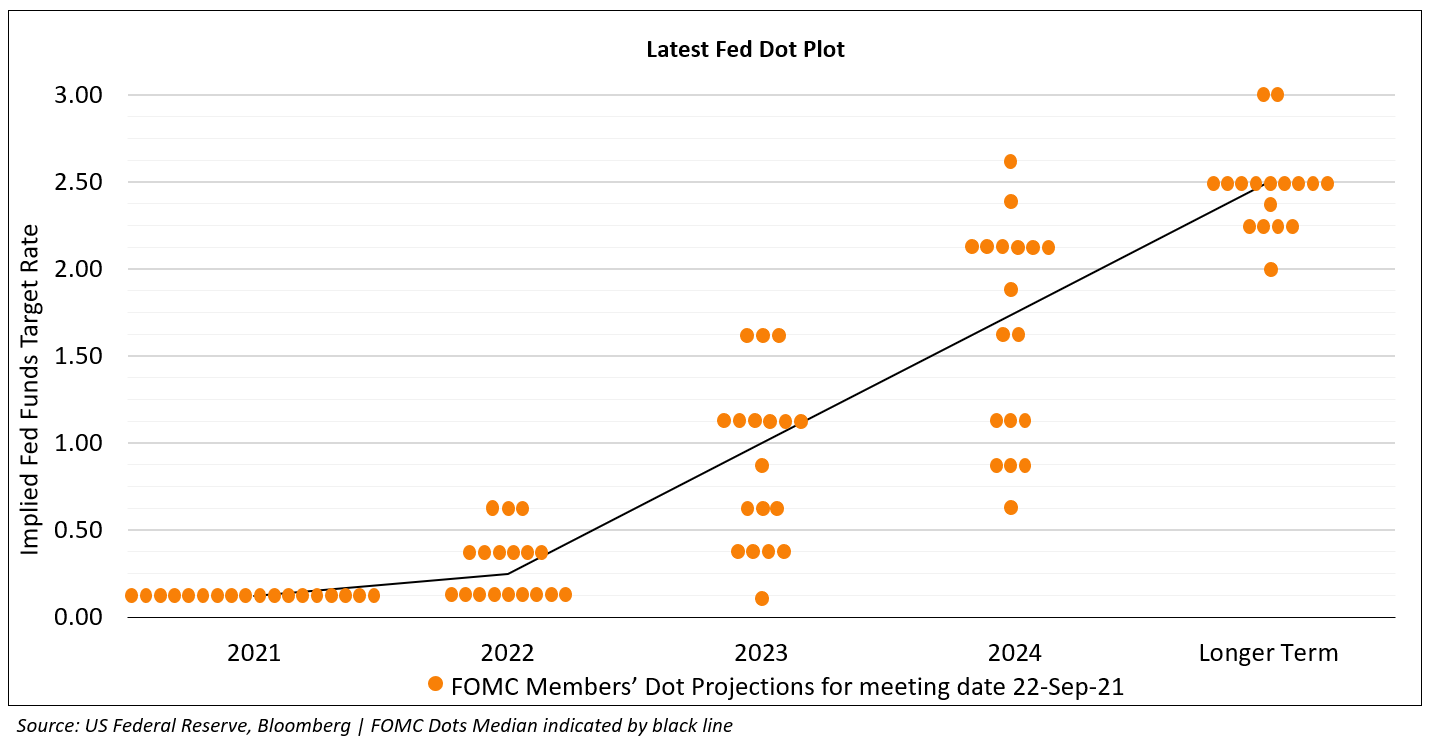

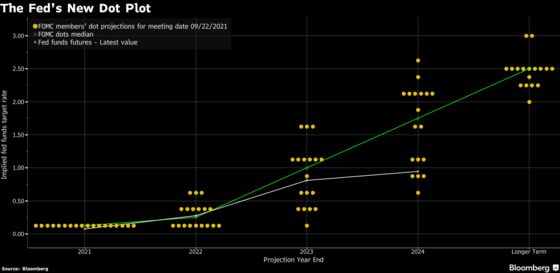

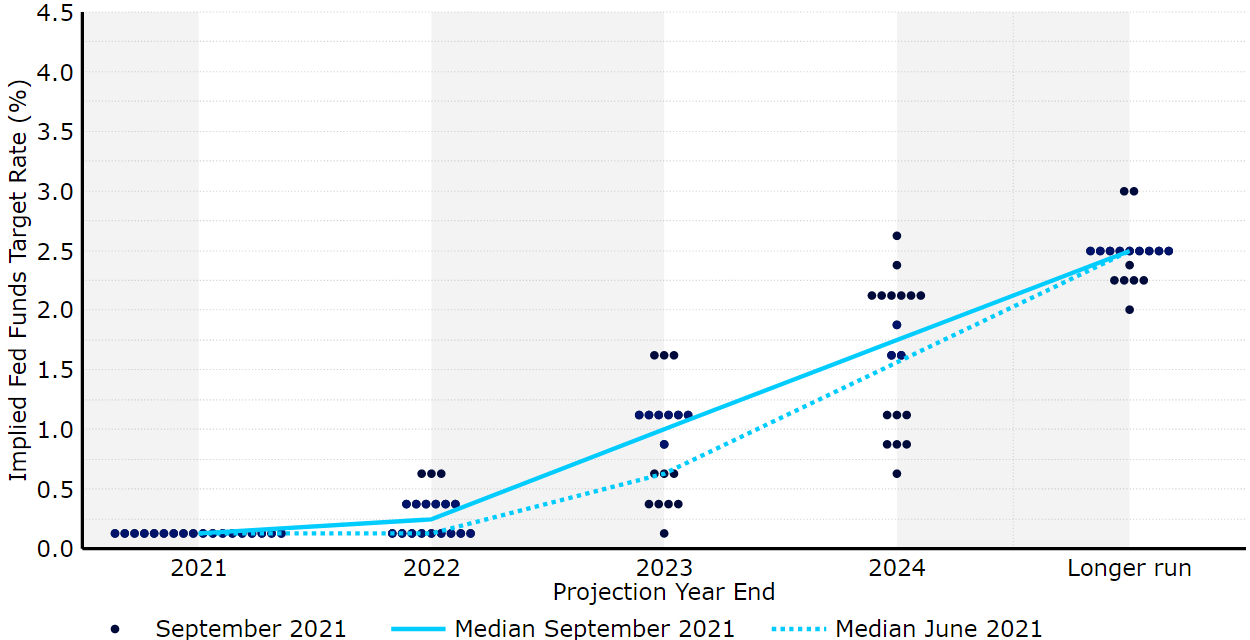

At the Federal Reserve we are strongly committed to achieving the monetary policy goals that Congress has given us. The Fed said the 2021 inflation forecast is 42 and that inflation will remain above the Feds target rate of 20 until 2024. Powells FOMC press conference The FOMC central tendencies and dot plot from the September 2021 meeting FOMC statement.

For release at 200 pm EDT September 22 2021 Summary of Economic Projections In conjunction with the Federal Open Market Committee FOMC meeting held on September 21-22 2021 meeting participants submitted their projections of the most likely outcomes for real gross domestic product GDP growth the unemployment rate and inflation for each year from 2021 to 2024 and over. Analysts are mixed as to whether they believe that the Fed will announce the start of tapering its asset purchases tomorrow. M toggles mute onoff.

Full statement from the September 2021 FOMC meeting. Nov 3 2021 Federal Reserve. Central tendencies for 2021.

Heres What the Fed Could Do. SECTORS MOSST ADVERSELY AFFECTED BY THE PANDEMIC HAVE IMPROVED IN RECENT MONTHS BUT SUMMER RISE IN COVID SLOWED RECOVERY FOMC federalreserve tweet at 209pm. 2 days agoDow Jones Price Resilient After FOMC Rate Decision Updated Rate Projections 2021-09-22 180000 Live.

Httpslearn2tradego-premium Live Forex Commodities Indices. THE ROUTE OF THE ECONOMY WILL CONTINUE TO BE DETERMINED BY THE PATH OF THE VIRUS. Data lies just ahead this morning that could move the markets.

Powell projects a November taper announcement Matt Weller CFA CMT September 22 2021 754 PM. Comparing September with November FOMC statements. FOMC announcements inform everyone about the US Federal Reserves decision on interest rates and are one of the most anticipated events on the economic calendar.

Join Our VIP Telegram Channel HERE. Traders are now awaiting Fed Chairman Jerome Powells press conference which will be closely scrutinized especially any comments on the timing of the Feds likely tapering its bond-buying program and also inflation prospects. FOMC Meeting Schedule 2021 FOMC Federal Open Market Committee is the branch of the US Federal Reserve that determines the course of monetary policy.

Wed 3 Nov 2021 180257. Home Calendars FOMC Meeting Schedule 2021. The Federal Reserve is committed to using its full range of tools to support the US.

Central tendencies September 2021. Page 1 of 27. Market Overview Analysis by AmplifyME Anthony Cheung covering.

Sep 21 2021 2301 UTC 8 min read If 11715 intraday lows hold on the H1 an ABCD bearish pullback to prime resistance at 11767-11776 may be. This new round of quantitative easing has caused their balance sheet to exponentially swell and as of September 15 the Federal Reserve has amassed 84 trillion in assets. Fomc meeting today live.

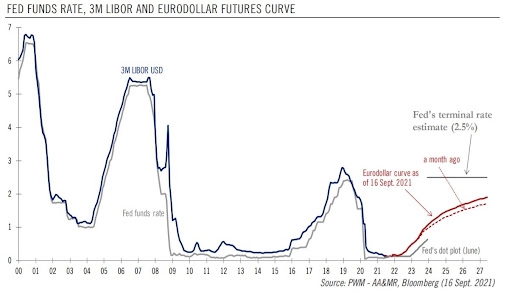

What to expect from the Feds FOMC meeting July 28 2021 808 AM The Federal Reserve is making an announcement on interest rates this afternoon after two days of meetings. A Forex Traders Guide Nov 3 2021 USDJPY Trades in Bull Flag Formation Ahead. At the time seven Fed officials expected rate hikes in 2022 and 13 Fed officials saw hikes in 2023.

FOMC Announces Taper at November Rate Decision Nov 3 2021 The Federal Reserve Bank. September 22 2021 Chair Powells Press Conference FINAL. Bank of England Monetary Policy meeting decision due 4 November 2021 - a line.

Maximum employment and price stability. The data from the US showed that the Core PCE inflation remained unchanged at 36 on a yearly basis in September. Transcript of Chair Powells Press Conference September 22 2021.

September 21 2021. From FinancialJuice 22 min ago 3 comments.

Fed On Track To Announce Qe Tapering 100fxb

Central Bank Watch Fed Speeches Interest Rate Expectations Update September Fed Meeting Preview

Fed Meeting Preview Dot Plot And Economic Forecasts In Focus Ig Bank Switzerland

Fomc Dot Plot From The September 2021 Meeting Xtb

Fomc Event Risk How Will The Market React

Fed Reserve Decision And Dots Turn Hawkish Track Live Bond Prices Online With Bondevalue App

Fed Meeting 2021 Debate On Raising Interest Rates Tapering Just Got Harder Bloomberg

Fomc Dot Plot From The September 2021 Meeting Xtb

Fomc Dot Plot From The September 2021 Meeting Xtb

Federal Reserve Bank Of San Francisco Fomc Rewind September 2021 Video

The Fed S New Dot Plot After Its September Rate Meeting

Fed Indicates November Qe Taper Announcement On The Way Ebury Uk

Fomc Event Risk How Will The Market React

Pin By Rockwelltrading On Daily Stock Update In 2021 New Market Stock Update Marketing

Fed Will Try To Keep Focus On Economy In Post Election Meeting Financial Times

Fed Signals Possibility Of 6 To 7 Rate Hikes Through 2024 As Taper Talks Advance